Screenshots are taken from past exam papers.

Find more papers

See the answer snippets here

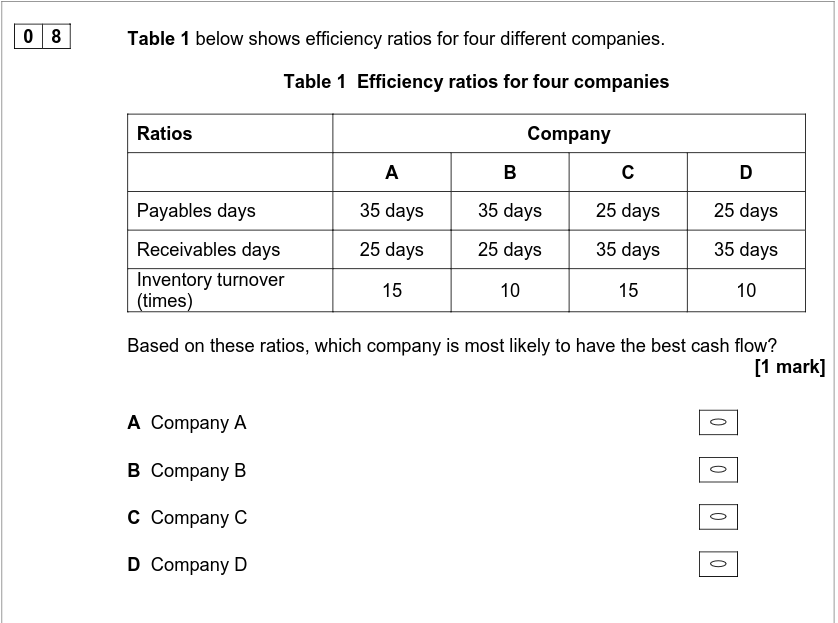

Payable days

Payables = Trade Payables / Cost of Sales x 365

Receivable days

Receivables = Trade Receivables / Revenue x 365

ROCE

ROCE (%) = Operating Profit / Total Equity + Non-current liabilities x 100

- Bigger is better

- Useful for

- Benchmarking

- Overviews

Inventory turnover

Inventory Turnover = Cost of Sales / Inventories

Current ratio

Current ratio = current assets/ current liabilities

- Determine the risk of running out of cash

- Normally presented as a ratio, but can be shown as a decimal or a fraction

Gearing ratio

Non-current liabilities / total equity + non-current liabilities x 100

- Optimum is between 20-50%

- Below 20% is too low

- Above 50% is too high

- The above is usually correct, there can be exceptions however

For question, see current ratio.