Opportunity Cost: The cost of missing out on the next best alternative. The benefits that could have been gained by making a different decision.

- Distinguish between scientific decision-making and intuition/hunch based decision-making.

- Scientific is easier to justify

- Scientific will usually be more reliable

- Hunch based is much faster

- But may be less reliable

- It is cheaper to use hunch based

- Scientific is more common due to the rise of Big Data

- Not key stages in the decision-making process:

- Recording data

- Setting objectives

- Scientific decision-making is a lot more trustworthy and reliable. It can be backed up with evidence and data that supports or opposes a decision. Scientific decision-making also makes use of a wider set of information than a hunch. Hunches may be based on 1 or 2 things, whereas a scientific decision may be based upon hundreds or even thousands of data points.

- Intuition/hunch based decisions can be useful for when action is required quickly. If you don’t have the time or resources to make a scientific decision, then intuition is your best chance.

- In any decision, you will need to account for all possible risks and uncertainty that may come from a decision, and weigh it up against the possible rewards. If you do this correctly, you are unlikely to make any decisions where you lose more than you can afford.

- Opportunity cost is the benefits that have been given up by making a particular decision over another.

- Opportunity cost helps you to see what your resources are going towards, and what you’re getting back. It allows for a more analytical overview of decision-making.

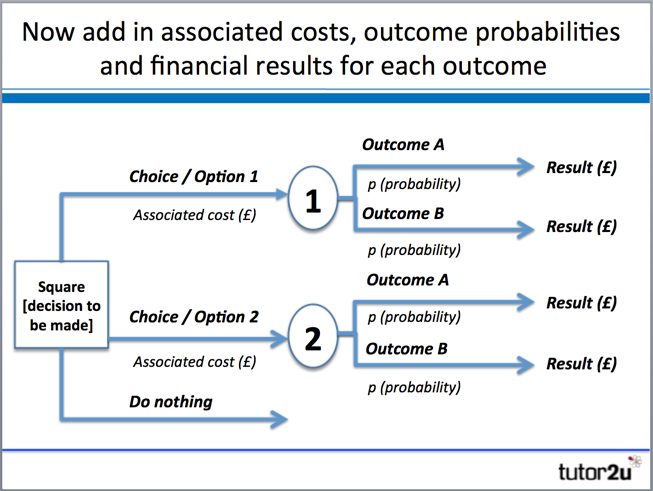

Decision Trees

- A mathematical model

- Used by managers to help make decisions

- Uses estimates and probabilities to calculate likely outcomes.

- Helps to decide whether the net gain from a decision is worthwhile.

Expected Value: The financial value of an outcome calculated by multiplying the estimated financial effect by its probability.

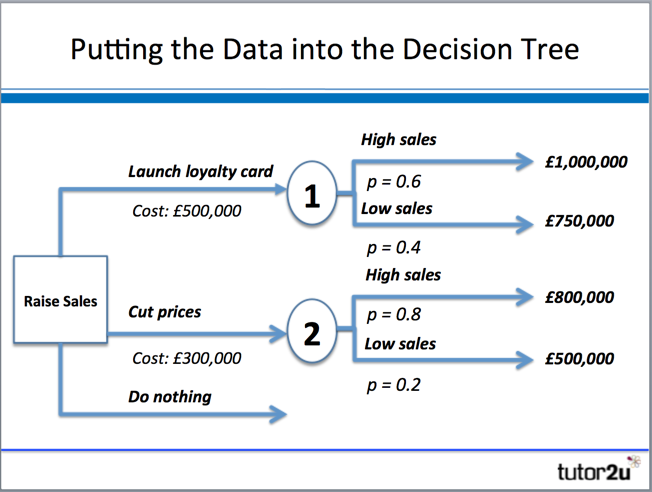

Example:

High sales + low sales = Total Expected Value

Net gain = Total Expected Value - Cost

(A):

1.4m cost

⇒ 40% 2.5m payoff ⇒ 60% 800k payoff

0.4 * 2500000 = 1000000 0.6 * 800000 = 480000

1000000 + 480000 = 1480000 (1.48m) 1.48 - 1.4 = 0.08m net gain

(B): 0.5m cost

⇒ 30% 1m payoff ⇒ 70% 0.5m payoff

0.3 * 1000000 = 300000 0.7 * 500000 = 350000

300000 + 350000 = 650000 (0.65m) 0.65 - 0.5 = 0.15m net gain (C):

Do nothing. Not optimal.

Option B is the most profitable option.

== {Express in a single unit—everything in millions would have been good}

Advantages of using decision trees

- Choices are set out logically

- Options are considered in parallel

- Use of probabilities enables risk analysis

- Likely costs are considered as well as potential benefits

- Easy to understand & tangible results

Disadvantages of using decision trees

- Probabilities are just estimates—can be erroneous

- Uses quantitive data only—ignores qualitative aspects of decisions

- Assignment of probabilities and expected values prone to bias

- Decision-making technique doesn’t necessarily reduce risk

Quality of data inputted is equal to the quality of the data outputted.